Tokenized Solar Bonds

Senior unsecured tokenized investment in a 9.6 MWp German Agri-PV project via a tokenized solar bond

Sustainable energy meets digital finance. For sustainability-oriented allocators, this is a 600,000 EUR tokenized, real infrastructure backed opportunity. Creating exposure to a short-duration 6‑month working capital tokenized Bond issued by the reputed Vindo Solar B.V. for a 9,6 MWp Agri-PV project with multiple execution safeguards in place.

Vindo Solar B.V. is building a 9.6 MWp solar PV project in Großglattbach, Germany. This project integrates fixed and single-axis tracking systems in an Agri-PV configuration. The tokenized bond raises 600,000 EUR in working capital to cover construction and EPC-BoS (Engineering, Procurement, Construction — Balance of System) related execution costs. The STO is managed with full compliance under MiFID II by Black Manta Capital Partners and the origination managed & facilitated by Penomo B.V.

HIGHLIGHTS

PROJECT OVERVIEW

The 600,000 EUR raised will support execution of a signed EPC-BoS contract for the Großglattbach solar PV project.

The capital will be used for supplier prepayments, project execution, and site mobilization. Construction is scheduled for September 2025 — January 2026, enabling the site to feed clean electricity into the medium-voltage grid by Q1 2026. Investors benefit from fixed returns, exposure to regulated infrastructure, and alignment with EU Green Taxonomy.

LOCATION OF THE PROPERTY

• Site: Großglattbach, Baden-Württemberg, Germany.

• Grid Connection: Medium voltage line via Netz BW GmbH.

• Design: 13,552 bifacial modules on fixed and single-axis trackers, Agri-PV layout.

• Compliance: VDE-AR‑N 4110 and DIN EN standards.

ABOUT THE ISSUER

Vindo Solar B.V., headquartered in Utrecht, Netherlands, is a family-owned engineering, procurement, and construction (EPC) company that is active throughout the Netherlands, Germany, Belgium, and wider Europe, as well as in select emerging markets.

With over 500 MWp of installed solar capacity and more than 100 projects delivered, Vindo Solar is a leading EPC and solar development company. The firm provides turnkey photovoltaic systems for commercial and utility-scale clients, including Vattenfall, BMW, Amazon, and TotalEnergies. Its deep engineering expertise and proven execution enable the company to support clean energy deployment under both public and private mandates.

The company’s way of working is based on core values: honesty, safety, teamwork, and quality. These principles are integrated into its daily operations on every job site and with every partner. Vindo Solar B.V. holds ISO 9001 (Quality), ISO 14001 (Environmental), and ISO 45001 (Occupational Health & Safety) certifications and applies these standards daily. The company also adheres to a strict code of conduct for ethical, HSE, and fair labor practices.

From project planning to on-site execution, Vindo Solar B.V. prioritizes health and safety, environmental responsibility, and clear communication. Clients trust the company because it delivers on its promises, adapts to challenges quickly, and builds with care. Vindo Solar’s reputation for quality and compliance was recognized when it was rated “Best EPC of 2023” by Hydro Rein.

Financial Information

KPI snapshots

• Gross margin: ~25.3% (2022), ~31.1% (2023), 36.5% (2024), 47.5% (2025 YTD).

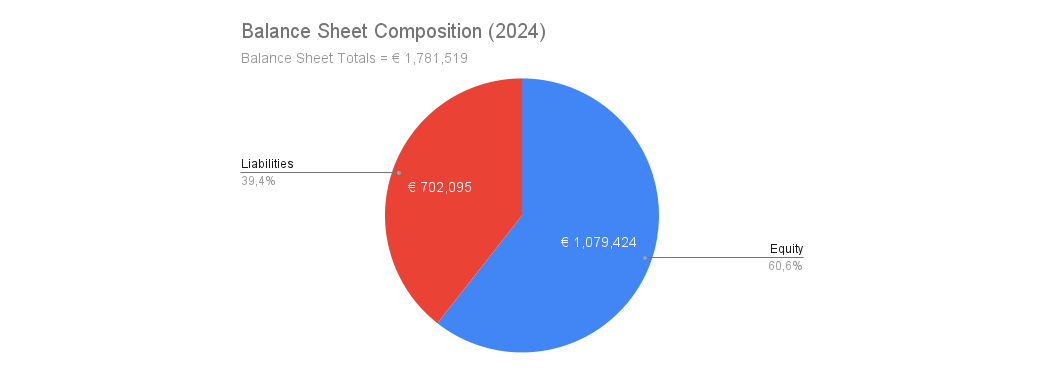

• Solvency (Dec 31): Equity/Total assets 29.5% (2022); ~60.6% equity vs 39.4% liabilities by Dec 31, 2024 (D/E ≈ 65%).

Key Trends

• Margin expansion despite revenue compression:

Gross margin stepped up from ~31.1% (2023) to 36.5% (2024) and ~47.5% (2025 YTD), indicating pricing power/mix improvement and tighter cost control.

• Consistent operating profitability:

Positive operating result in each period €234k (2023) > €242k (2024) > €191k YTD (Aug-2025) — showing resilient core earnings even through a transition period.

• Improving liquidity position vs. prior year:

2024 cash and near-cash increased vs. 2023 (and current liabilities dropped sharply in 2024), lowering short-term pressure while maintaining going-concern footing.

• Operational discipline:

Opex lines (staff, consulting, marketing, office, travel) remain controlled relative to gross profit growth in 2024 and 2025 YTD, supporting operating leverage.

Vindo Solar 2025‑I Token

Volume

EUR 600,000

For Professional Investors from

![]() Europe

Europe

| Issuer | Vindo Solar B.V. |

|---|---|

| Jurisdiction | The Netherlands |

| Instrument Type | Bearer Bond |

| Total Investment Volume | €600,000 |

| Min. Investment Amount per Investor | €100,000 |

| Max. Investment Amount per Investor | €600,000 |

| Coupon | 8% p.a. |

| Term | 6 months |

| Coupon Payments | Monthly |

| Principal Repayment | At maturity (6 months) |

| Denomination | €1.00 |

| Accepted Currencies | EUR, USD, USDC |

| Distribution Fee* (covered by the Issuer) | Up to 2% |

* The distribution fee covers technological improvements, employee training, etc.

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration and during the subscription process. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE PROJECT BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.