USMO — USD Short Term Yield

Open for subscription on 21X’s DLT regulated market infrastructure

The US Money Token is the first tokenized MMF compartment listed on an European DLT Exchange that can actively be traded on a regulated secondary market with direct settlement through Stablecoins.

The US Money (USMO) token provides exposure to the UBS (Irl) Select Money Market Fund – USD with accumulating yield providing qualified and institutional investors direct access to a yield-bearing instrument on the Polygon blockchain.

USMO tokens represent digital notes issued by BMCP Securities S.à r.l., acting on behalf of its dedicated Tokenized MMF Compartment. The core objective of the USMO offering is to mirror the performance of the underlying asset. The fund invests in short-term debt securities issued by U.S. and non‑U.S. governments and corporates, with all exposure denominated in USD to avoid FX risk.

HIGHLIGHTS

PROJECT OVERVIEW

USMO represents a tokenized note offering qualified and institutional investors interested in short-term yield products innovative access to the UBS (Irl) Select Money Market Fund – USD (MMF). This product is issued by Black Manta Capital Partners, with tokenization technology and distribution support from SBI Digital Markets.

The offering is available for subscription and redemption through 21X, Europe’s first fully regulated DLT trading and settlement system. The 21X platform uniquely allows professional investors to invest in these tokenized securities using stablecoins directly from their wallets.

Primarily targeting professional investors, financial institutions, brokerage firms, and treasuries, this initiative addresses the increasing interest in the tokenization of real-world assets, particularly money market funds. The demand for such regulated, accessible short-term yield products is significantly driven by the synergy of regulated stablecoins and the needs of wallet-based investors. Project USMO’s introduction on the 21X platform capitalizes on these market developments, advancing innovation and compliance within capital markets by providing access to traditional financial products, like the UBS MMF, through a modern, tokenized structure on a DLT-based system.

UNDERLYING FUND: UBS (Irl) Select Money Market Fund – USD

This actively managed fund aims to maximize current income in USD, while prioritizing liquidity and capital preservation. Its investment strategy centers on high-quality, short-term, USD-denominated debt securities issued by a diverse range of U.S. and non‑U.S. governmental bodies and other entities. The fund is classified as a Short Term MMF-LVNAV (Low Volatility Net Asset Value money market fund) and uses the SOFR Index (Secured Overnight Financing Rate) for performance comparison.

The UBS (Irl) Select Money Market Fund – USD is a UCITS-compliant fund domiciled in Ireland and demonstrates a strong commitment to high credit quality. It holds an AAAmmf rating from Fitch Ratings and an Aaa-mf rating from Moody’s. These ratings signify an extremely strong capacity to achieve its investment objective of preserving principal and providing shareholder liquidity by limiting credit, market, and liquidity risks.

As of February 28, 2025, the underlying share class held assets valued at $610.4 million, with a 7‑day net yield of 4.03% and a 30-day net yield of 4.04%. The total assets of the underlying MMF Fund reached $9.84 billion on this date.

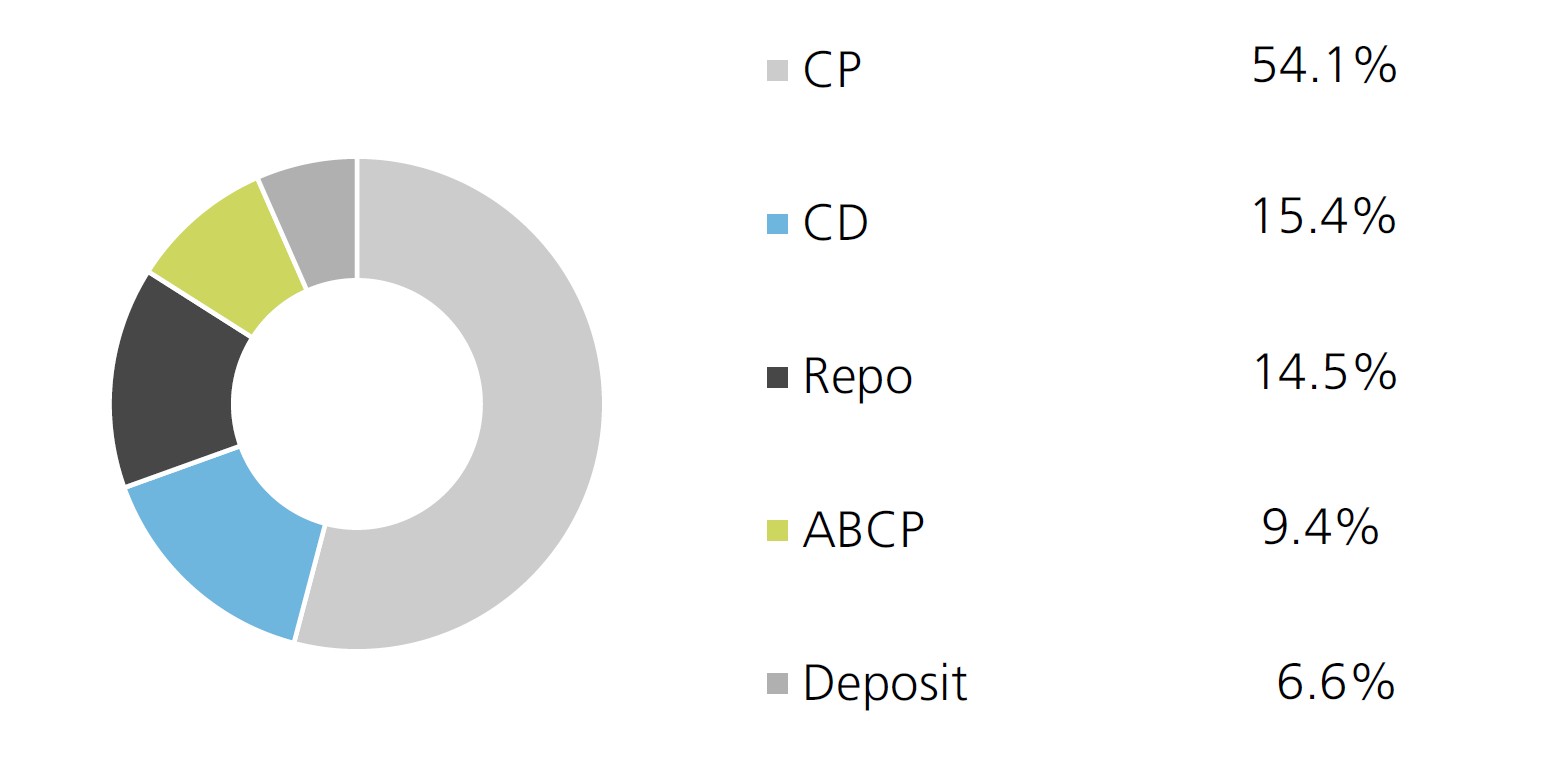

Portfolio Composition

Commercial Papers (54.1%), Certificate of Deposit (15.4%), Repurchase Agreement (14.5%), Asset-Backed Commercial Paper (9.4%), Deposit (6.6%) — investments were largely concentrated in A1 (53.3%) and A1+ (46.5%) rated securities.

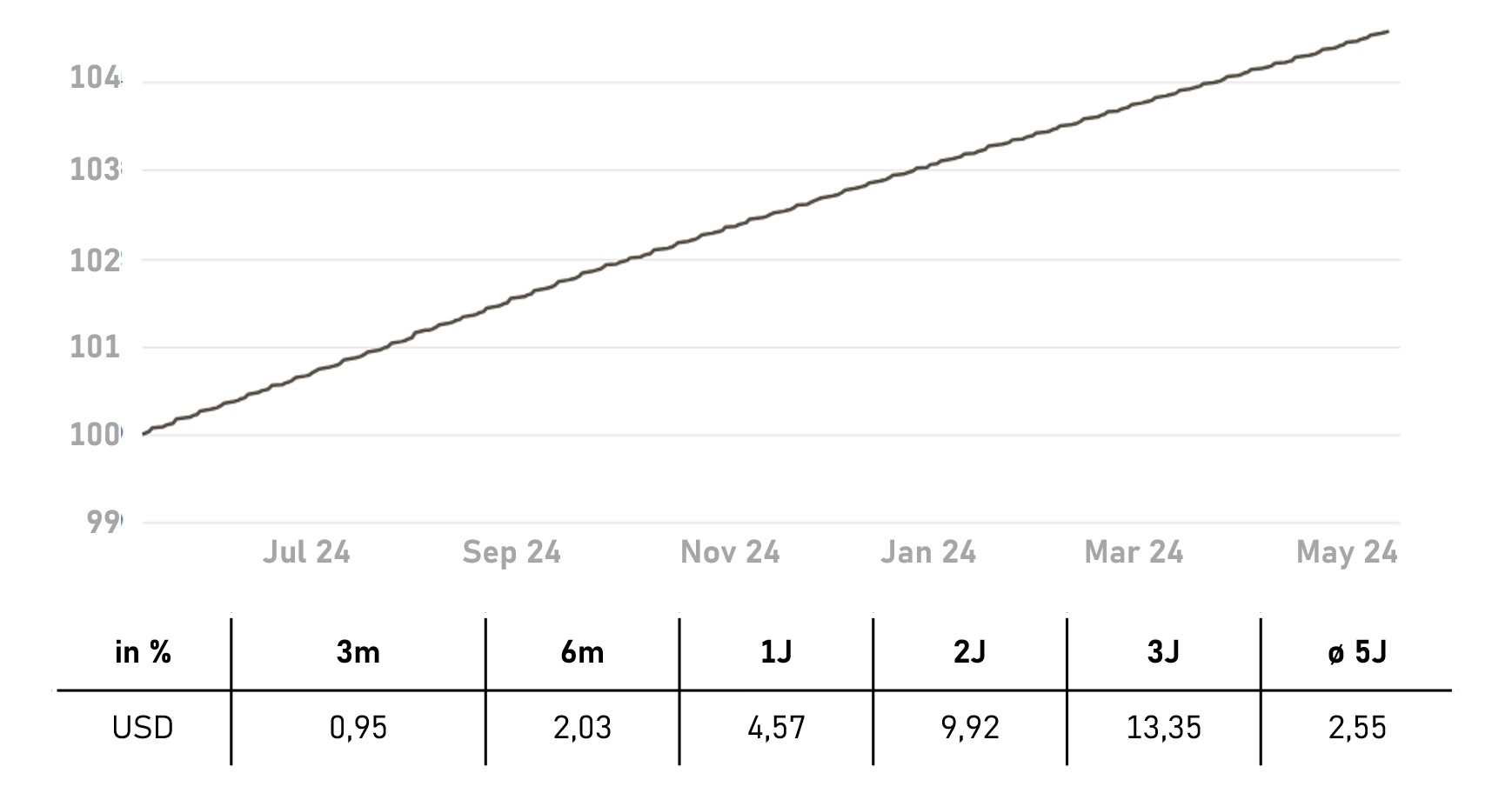

Underlying Fund Performance YTD (in %, per May 15, 2025)

ABOUT 21X

21X is a Frankfurt-based financial institution at the forefront of revolutionizing capital markets through the use of blockchain technology. In December 2024, 21X secured a license to operate its groundbreaking distributed ledger technology trading and settlement system (DLT TSS) a milestone that places the company as a leader in the transition to digital finance. The company is ideally positioned to enable smart contract-based issuance, trading and settlement of tokenized stocks, bonds and funds.

Operating as Trading Venue, Market Operator and Listing Sponsor.

Web: https://21x.eu/

ABOUT SBI DIGITAL MARKETS

SBI Digital Markets is a subsidiary of SBI Digital Asset Holdings, the digital asset arm of Japan’s leading conglomerate SBI Group. With the largest securities account customer base and second-largest trading market in Japan, SBI Group has a global network across 26 countries and regions including key markets in Asia and Europe. SBI Digital Markets offers clients a comprehensive digitalisation framework from origination, tokenisation, distribution to custodian services across traditional and Web 3 product.

Operating as Tokenization Agent, Custodian and Broker.

ABOUT THE ISSUER

Our Luxembourg-based securitization vehicle — BMCP Securities S.à r.l. — offers a compartment structure, which segregates assets and liabilities for each distinct issuance, protecting each compartment from the risks associated with other compartments and assets. The vehicle operates under Luxembourg’s robust legal framework and is designed to accommodate diverse financial instruments and market access.

Read more here: https://blackmanta.capital/securitization/

About Black Manta Capital Partners

Black Manta Capital Partners is a next generation investment bank focused on digital and tokenized assets, operating a fully regulated investment platform for issuances in the European capital market, as well as a Securitization Vehicle out of Luxembourg. With offices in Europe, Asia and Americas, Black Manta Capital offers full-service support for all technical, financial, and legal aspects of asset and security tokenization on a global scale.

USMO TOKEN

Volume

USD 500,000,000

For Qualified & Institutional Investors from

![]() Global

Global

| Issuer | BMCP Securities S.à r.l. |

|---|---|

| Jurisdiction | Luxembourg |

| Instrument Type | Tokenized Note |

| ISIN | LU3078479147 |

| Digital Token Identifier | 7K24SW2NW |

| Issue Date | 16 May 2025 |

| Maturity Date | 31 May 2045 |

| Redemption | Early redemption option |

| Min. Investment Amount | $10,000 |

| Max. Investment Amount | N/A |

| Smart Contract | Link |

| Blockchain | Polygon PoS |

| Accepted Currencies | USDC (ETH) |

Underlying Fund Details

| Name | UBS (Irl) Select Money Market Fund – USD |

|---|---|

| Invest. Manager | UBS (Irl) Fund Plc |

| ISIN | IE00BWWCPZ76 |

| Payouts | Accumulating |

| Fund Ratings | AAAmmf, Aaa-mf |

| Fund Currency | USD |

| SFDR Classification | Art. 8 |

| Total Expense Ratio (TER) | 0,50% p.a. |

Conditions

| Fees | See investor documentation |

|---|

Service Providers

| Tokenization Agent | SBI Digital Markets |

|---|---|

| Custodian | SBI Digital Markets |

| Broker | SBI Digital Markets |

| Trading Venue | 21X AG |

| Market Operator | 21X AG |

| Listing Sponsor | 21X AG |

| Calculation Agent | BMCP Consulting GmbH |

| Digital Asset Broker | BMCP GmbH |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration and during the subscription process. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

Contact

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE PROJECT BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.