LYQD Irish Whiskey Bond

Capitalizing on a high-growth Market in alternative assets

This investment opportunity provides qualified investors with access to a portfolio of Irish Whiskey assets, capitalizing on the market’s strong growth dynamics and offering a compelling return profile.

This project presents a distinct opportunity for qualified investors to participate in the dynamic expansion of the Irish whiskey market. By leveraging the substantial purchasing power of a pooled investment fund, this bond acquires select whiskey assets from independent distilleries, capitalizing on market demand and achieving economies of scale.

A dedicated industry partner with over 35 years of experience in the whiskey, hospitality and wholesale sectors guides the asset selection process, ensuring strategic acquisitions and optimized portfolio management.

HIGHLIGHTS

INVESTMENT STRATEGY OVERVIEW

The portfolio strategy involves actively managing deployed capital on a rolling basis, prioritizing target returns and a carefully optimized risk-return profile. The strategy includes an overweight allocation to new/young production to maximize rapid asset appreciation, acquisition of mature premium whiskey at significant value requiring stock liquidation, and ad-hoc trading as value propositions arise. The diversified portfolio encompasses various established and boutique distilleries, whiskey types, and product maturities to manage exit strategies and achieve target investor returns. Multiple exit opportunities include wholesale pre-sale contracts, partnerships with industry players and large-scale distributors, white label retail agreements, and ad-hoc sales through the LYQD Cask Exchange.

The strategy aims to capitalize on market momentum with timely acquisitions and strategic capital flow management, leveraging investment volume and operational efficiencies. An outperformance bonus, split upon exits, aligns incentives across the investment lifecycle and is distributed to investors if the yield of the underlying assets exceeds the target net return.

Market Opportunity

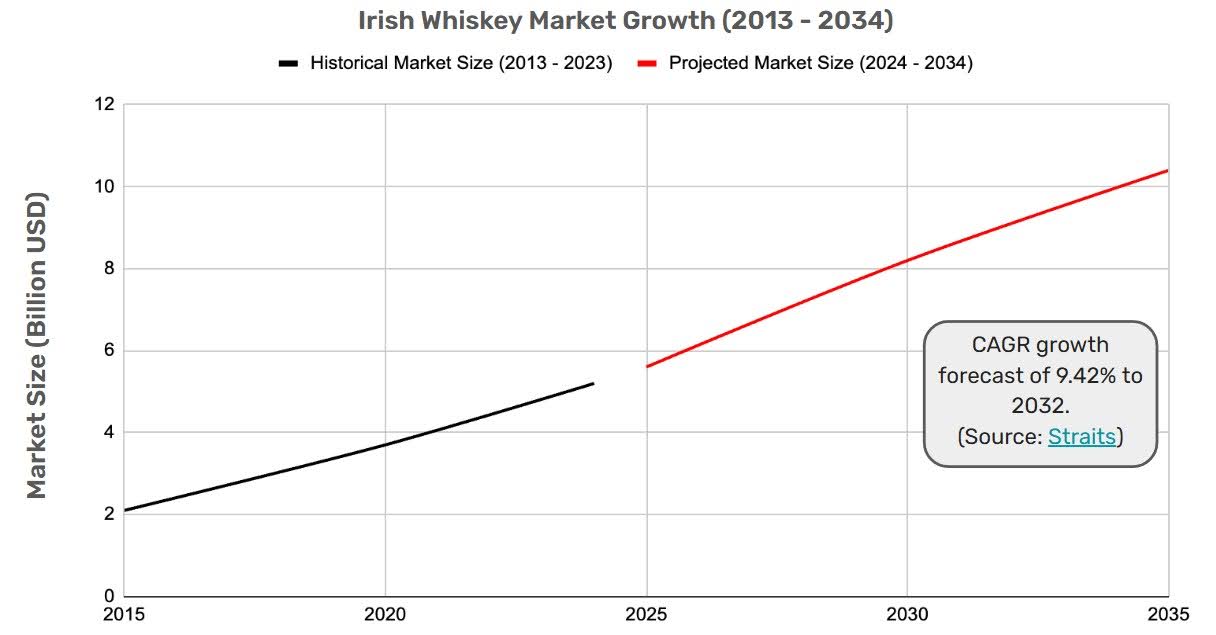

The Irish whiskey distillery market has experienced substantial growth over the past 15 years, increasing from 4 to over 40 distilleries, driving demand for stock financing. Irish whiskey is an established product with over 750 brands and a recognized alternative investment asset in the global whiskey market. Historical average performance returns of 10% p.a. (Source: KPMG) provide a benchmark, while this investment targets higher net returns of 12% p.a. by leveraging bond purchasing power and associated economies of scale on operating costs. Irish whiskey exports have demonstrated significant growth, with a 67% increase in the last decade and a projected 80% increase by 2032 (from $5.1 billion in 2023 to $9.2 billion in 2032).

This aligns with broader market trends, as highlighted by PWC, which notes the increasing allocation to alternative investments globally, with diversified portfolios leading investor returns. A recent Forbes survey further underscores this trend, revealing that 84% of retail investors would consider alternative assets.

Figure 1. Irish Whiskey Market Growth (2013 — 2034)

The Irish Whiskey Market is expected to grow to over $10bn valuation by 2035.

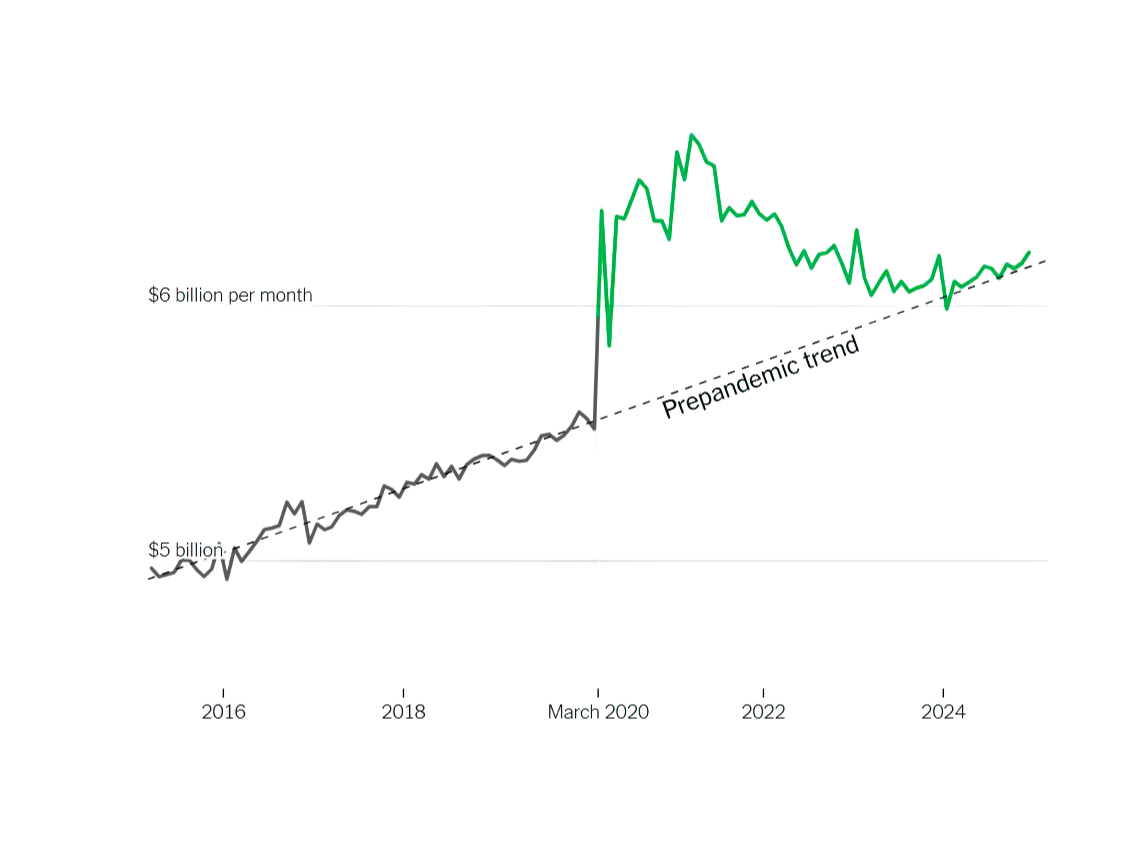

Figure 2. American Retail Alcohol Consumption — Market Consumption Correction to Pre-Pandemic levels

The retail alcohol consumption figures experienced significant growth during the pandemic. Consumption growth levels have returned to previously projected levels.

MANAGEMENT TEAM

Maurice Tracey — Lead Partner

Maurice Tracey is the Managing Director of BMCP Securities SarL — He brings over 25 years track record in Commercial Banking, and has held various board & senior positions.

Finn McGahan — Transaction Manager

Finn McGahan is a Vice President in Black Manta Capital Partners — He studied Banking & Finance at UCC, and has spent the last 3+ years building various Decentralized Finance and Tokenization startups.

James Jardella — Commercial Expert

James is the CEO of LYQD — James brings over 15 years of leadership experience across strategy, commercial growth, and brand development in the consumer goods sector.

Ernest Cantillon — Industry Expert

Ernest Cantillon is the COO of LYQD. He studied commerce before spending the past 20 years immersed in the hospitality and alcohol industry. He founded and successfully grew Kinsale Spirit Co, an Irish whiskey and gin company, before exiting to concentrate on building an exchange for cask whiskey.

Maurice Tracey, Finn McGahan, James Jardella and Ernest Cantillon (from left to right)

LYQD CASK EXCHANGE

LYQD Cask Exchange transforms whiskey cask investing by introducing real liquidity, transparency, and trust into a historically opaque market.

Founded by whiskey and ecommerce veterans Ernest Cantillon and James Jardella, LYQD is a validated trading platform that ensures authenticated casks, vetted traders, fair market pricing and sustainable growth.

The platform’s pre-revenue funding round was oversubscribed by 133%, raising €1.2m with support from Enterprise Ireland, demonstrating strong demand for a secure and efficient whiskey trading venue.

For the Irish Whiskey Bond, LYQD will provides significant advantages:

• Live market pricing for cask assets post launch.

• Buy/Sell liquidity through a marketplace.

• Improved asset valuation accuracy and superior reporting standards.

• Exit opportunities for investors without undermining the bond’s structure.

By leveraging LYQD, the Irish Whiskey Bond offers investors a secure, profitable, and liquid alternative investment — future-proofing whiskey as an asset class and positioning the bond ahead of competitors in the market.

Step 1: Qualified investors approval and onboarding including KYC/AML via Black Manta Capital Partners (BMCP) platform.

Step 2: Investors deploy funds into Luxembourg SV Irish Whiskey High Yield Bond compartment.

Step 3: Investors funds are pooled until minimum reserve requirement is achieved.

Step 4: Once minimum reserve is achieved, funds are deployed to buy whiskey assets over 6 month procurement period, to allow assets acquisition at value in line with the bond investment strategy.

Step 5: Capital deployed in line with bond investment strategy.

Step 6: Whiskey Assets will be stored in accredited 3rd party Bonded Warehouses, and will be subject to ongoing asset audit at a minimum of every 6 months.

Step 7: Whiskey assets will be fully insured at prevailing market value as they appreciate in value over the resting period in particular at the key appreciation milestones at years 3 and 5.

Step 8: Ongoing regular asset auditing, monitoring and reporting to provide asset performance and risk management clarity.

Step 9: Deployment of exit strategies.

Step 10: At the end of the term (5+1 years), investor principal and yield is returned to investors, via Black Manta Capital Partners.

Irish Whiskey High-Yield Bond

Target Fund Raise

EUR 20,000,000

For Investors from

![]() Europe

Europe

| Issuer | BMCP Securities S.à r.l. |

|---|---|

| Securitization Vehicle | BMCP Securities S.à r.l. |

| Bond Partner | Barrica Limited trading as LYQD |

| Jurisdiction | Luxembourg |

| Instrument Type | Bond |

| Total Investment Volume | €20,000,000 |

| Reserve Requirement | Minimum issuance threshold €5,000,000 |

| Min. Investment Amount | €10,000 |

| Max. Investment Amount | N/A |

| Targeted Yield | 12% p.a. on asset level after costs |

| Start of Offering | TBD — Pre-Launch Book Building |

| End of Offering | N/A |

| Term | 5+1 years |

| Accepted Currencies | EUR |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

The Issuer is solely responsible for all contents and information provided regarding the offering. BMCP GmbH acts as a pure intermediary and assumes no liability for the accuracy of the provided content.

For its distribution services BMCP receives ongoing fees for investors AUM coming through BMCP of 12,5% of the revenue on deposits.

Barrica Limited (trading as LYQD)’s role as a Bond Partner is as a Whiskey Industry Specialist only. Bond issuance and compliance are managed by BMCP and other named service providers

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE BONDS BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.