Project GMDC

Enticing investment potential in a pre-leased asset in a developing city in India

The GMDC Project presents investors with an opportunity to participate in the development of a managed office center, complete with pre-committed occupants. The project aims to achieve a targeted annual yield of 8.5% by developing this premium asset in the emerging city of Ahmedabad, India.

The issuer is currently extending an invitation to professional investors to participate in the investment opportunity. The capital raised will be utilized for the construction, operation, and leasing of an office building in a prime location with high demand. Investors can anticipate robust risk-adjusted returns by gaining exposure to an outstanding, rapidly growing real estate environment, coupled with the expertise of a seasoned team boasting a proven long-term successful track record.

The total building capacity of Project GMDC is 44,600 m², distributed among office (80%), residential (12%), and retail (8%) spaces to optimize revenue generation and maximize profits.

HIGHLIGHTS

PROJECT OVERVIEW

Project GMDC is envisioned as a distinctive office space that will cultivate a campus-like atmosphere, incorporating open spaces and overlapping work areas to promote interactivity and flexibility. The issuer is committed to creating informal spaces for recreational activities to shape a vibrant and positive corporate culture within the building. The strategic placement of the retail area in a prime location, easily accessible from the street, aims to boost demand among potential retail tenants.

In addition to offering appealing amenities such as cricket and tennis facilities, the building places a strong emphasis on sustainability and energy efficiency. Electricity for common areas will be sourced from photovoltaic (PV) systems. The project boasts an Indian Green Building Council rating, highlighting its commitment to reduced carbon emissions and a minimized environmental impact.

The issuer together with the tenant of the office space DevX — the visionaries behind this project — bring a wealth of offerings to the table, including management expertise, local experience, an excellent and lengthy track record in commercial real estate, project sourcing and realization experience, and a dedicated project team with over 60 employees.

The GMDC project presents an equity participation opportunity with a total investment volume amounting to $57,000,000, which will be used to build, operate and rent out the building. Investors can anticipate a targeted yield of 8.5% per annum and a targeted IRR of 16% in the event of an early exit. Tokenization for this project is optional, providing flexibility for investors.

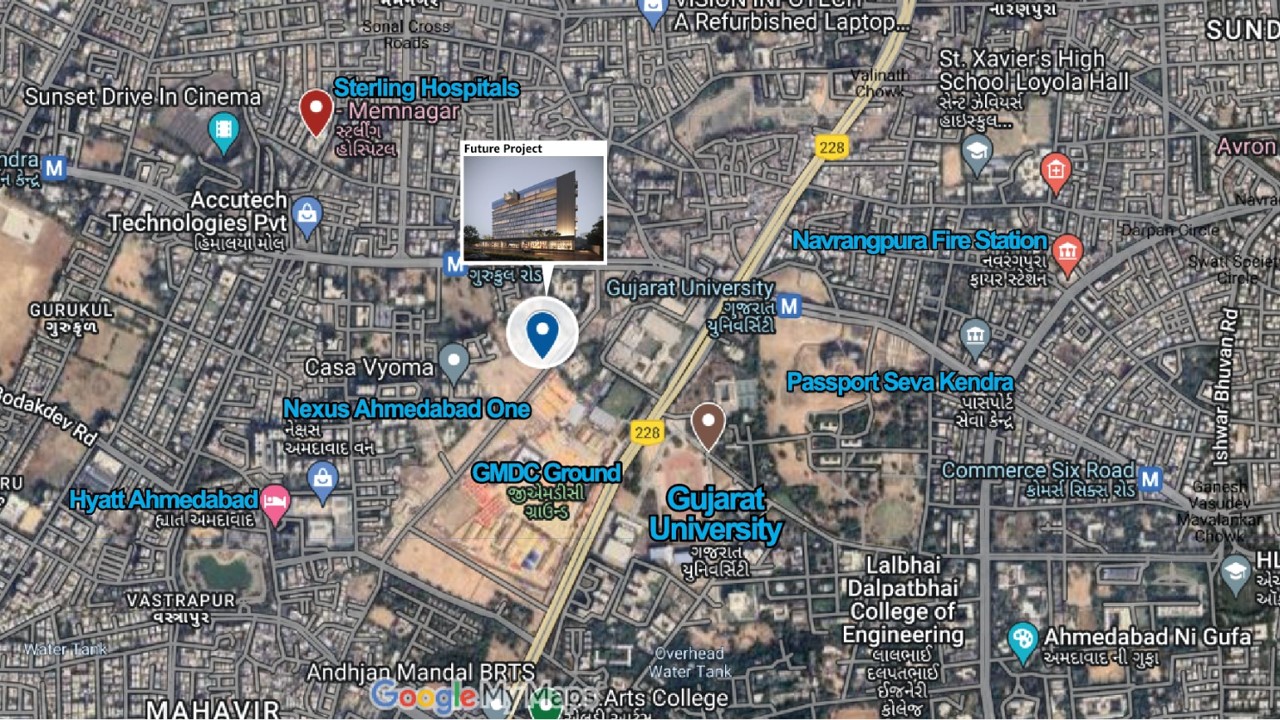

PROJECT LOCATION

Situated in Vastrapur, Ahmedabad, Gujarat, India, the managed office space provides an optimal environment for enterprise and MNC clients. Its strategic placement in a bustling neighborhood positions it in close proximity to shopping malls, a hospital, universities, and dynamic student communities. This premier location ensures startups have convenient access to essential services and a diverse talent pool, fostering an environment conducive to growth and innovation.

ABOUT DEVX (Tenant of Project GMDC)

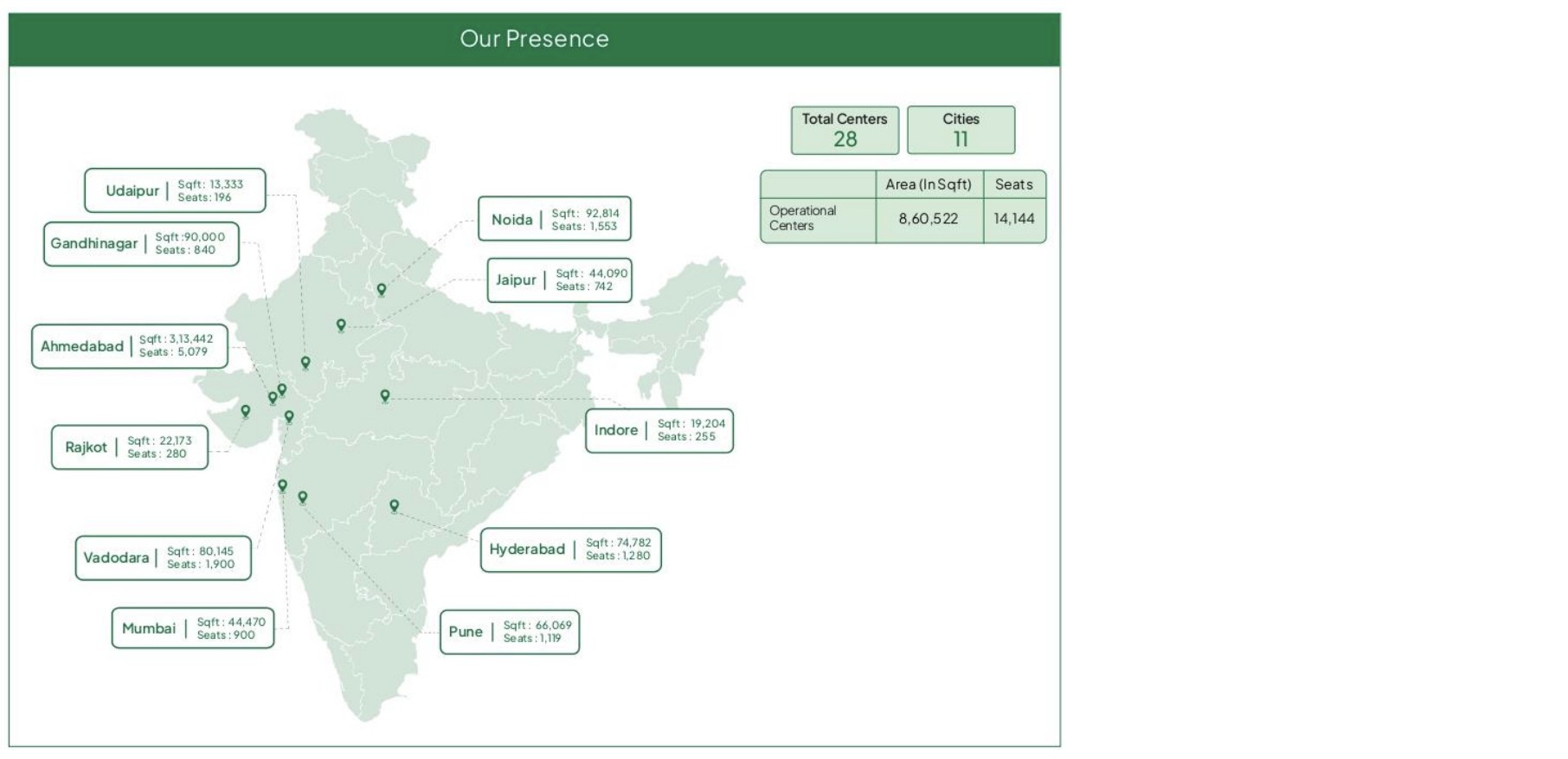

Dev Accelerator Ltd (DevX) stands as Gujarat’s largest co-working company, with an expanding presence into new areas and is a company known for providing flexible office spaces and co-working solutions. DevX maintains a substantial operational footprint across India, specializing in Built to Suit Managed Office Solutions for enterprises. The company’s combined strategy targets key financial hubs and high-growth emerging cities, resulting in a total presence spanning 15+ submarkets.

The company’s operations cover major Tier 1 markets (Delhi NCR, Hyderabad, Mumbai, and Pune) and crucial Tier 2 growth markets (Ahmedabad/Gandhinagar, Indore, Jaipur, Udaipur, and Vadodara).

Collectively, DevX manages an operational portfolio of nearly 74,300 square meters with a seating capacity exceeding 13,700 seats across all these locations.

The firm recently announced an Initial Public Offering (IPO) with the primary goal of funding strategic expansion. The capital raised is intended to cover new centers’ fit-out costs, repay debt, and bolster its physical presence in major Indian cities such as Mumbai, Pune, and Ahmedabad.

DevX managed office centers

MANAGEMENT TEAM

Co-Founder and Chief Growth Officer

• 10 years in IT & Real Estate, Strategic Thinker with Marketing and Sales expertise, Startup Enthusiast, and Entrepreneur.

• Focus on Strategic Partnerships, Long-term Growth Strategies, and curating Technology Startups/SMEs for the Accelerator program.

• Leads Sourcing, Negotiating, and on-boarding of Strategic Partners, emphasizing like-minded collaborations.

• Board Member (Investor) and Mentor for SaaS, Mobility, Cloud Kitchen, Media Tech, and Lending ventures.

• Experience: Marketing/Sales Consultant at a 100-year-old Manufacturing firm in the UK.

• Active Investor and Mentor for Startups, facilitating their transition from Ideation Stage to Growth stage.

Co-Founder and Chief Operation Officer

• 10+ years in operations, go-getter in commercial real estate, passionate about disruptive office space solutions.

• Process advocate, serial entrepreneur, supports startups in streamlining processes.

• Started as a soft skill trainer, transitioned to streamlining and automating hiring processes, established 2 successful startups.

• Leads Phi designs for interior designing and oversees digital marketing solutions for DevX.

• Active investor, accelerates tech startups with fellow co-founders.

Co-founder and Chief Engagement Officer

• 7+ years in IT, specializes in Network Infrastructure Management.

• Inspired by technology and digital transformation, brings innovative solutions to CRE industry.

• Expert in client relationship management and negotiation, focuses on efficient operational solutions.

• Heads Purchase, Admin, Legal, and Network departments, building strong connections with Vendors, Builders, Strategic Partners, and Clients.

• Aims to establish DevX as the pioneer brand in the Office Space Industry with co-founders.

DX102 Token

Target Fund Raise

USD 57,000,000

For Investors from

![]() Worldwide

Worldwide

| Issuer | Ausil Enterprises Private Limited |

|---|---|

| Jurisdiction | India |

| Instrument Type | Equity Participation |

| Total Investment Volume | $57,000,000 |

| Min. Investment Amount | $100,000 |

| Targeted Yield | 8.5% p.a. |

| Targeted IRR (early exit scenario) | 16% |

| Start of Offering | Q4/2025 |

| Accepted Currencies | USD, INR, EUR |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal Polygon wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

The Issuer is solely responsible for all contents and information provided regarding the offering. BMCP GmbH acts as a pure intermediary and assumes no liability for the accuracy of the provided content.

BMCP GmbH works on a success fee basis of up to 3% of raised capital. The fee covers technological improvements, employee trainings, etc. in BMCP GmbH.

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE BONDS BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.