LynxCap Real Estate Bond

Stability From Real Estate and Yield From LynxCap’s Expertise

LynxCap is a Swiss-based investment company specializing in analyzing, acquiring, and managing real estate-secured claims and real estate-owned assets from European commercial banks since 2008. To date, LynxCap has completed over 150 portfolio transactions and invested more than 650 million Euros.

LynxCap’s partnerships with European commercial banks create a win-win scenario, allowing these banks to offload non-core assets while reducing capital pressures and navigating provisioning regulations. This collaboration enables LynxCap and its investors to access diversified real estate portfolios at attractive valuations, ensuring stability from real estate and yield from its expertise.

LynxCap offers a single robust product — Luxembourg-listed bonds that provide exposure to real estate security with yields higher than typical real estate funds. Unlike regular funds, LynxCap pledges all profits for the benefit of its bondholders. Luxembourg adheres to world-class standards, including audit requirements and having an independent paying and security agent, which in LynxCap’s case is Apex Group. All assets are properly managed and pledged to bondholders, and these rights will also extend to token holders.

HIGHLIGHTS

PROJECT OVERVIEW

LynxCap’s partnerships with European commercial banks create a win-win scenario, allowing these banks to offload non-core assets while reducing capital pressures and navigating provisioning regulations. This collaboration enables LynxCap and its investors to access diversified real estate portfolios at attractive valuations, ensuring stability from real estate and yield from its expertise.

At LynxCap, the company offers its investors a single, robust product: Luxembourg-listed bonds, directly linked and secured by the portfolios it acquires. These bonds provide access to a unique alternative investment asset class, yielding higher returns than traditional real estate products.

As a company owned by its management and employees, LynxCap fosters a culture of alignment with its investors’ interests. This commitment is evident in the company’s practice of always taking a junior position in all acquisitions, subordinating future earnings for the benefit of its bondholders.

Additionally, LynxCap provides a parent guarantee for its bonds, further ensuring the security of its investors’ interests. Apex Group Ltd. provides security agent services, acting as fiduciary to the bondholders, which ensures independent control of all company actions in line with best practices in the investment industry.

All assets are audited, properly managed, and pledged to bondholders, with these rights also extending to token holders.

Funds raised will be strategically invested in real estate-secured claims and portfolios of owned real estate (REO’s) in key markets, sourced from selected commercial banks and other financial institutions across Europe. Token holders will invest alongside LynxCap’s existing investors, such as pension funds and large asset managers from Europe, the US, South Korea, and Singapore. Each token will be linked to a specific bond, providing full transparency.

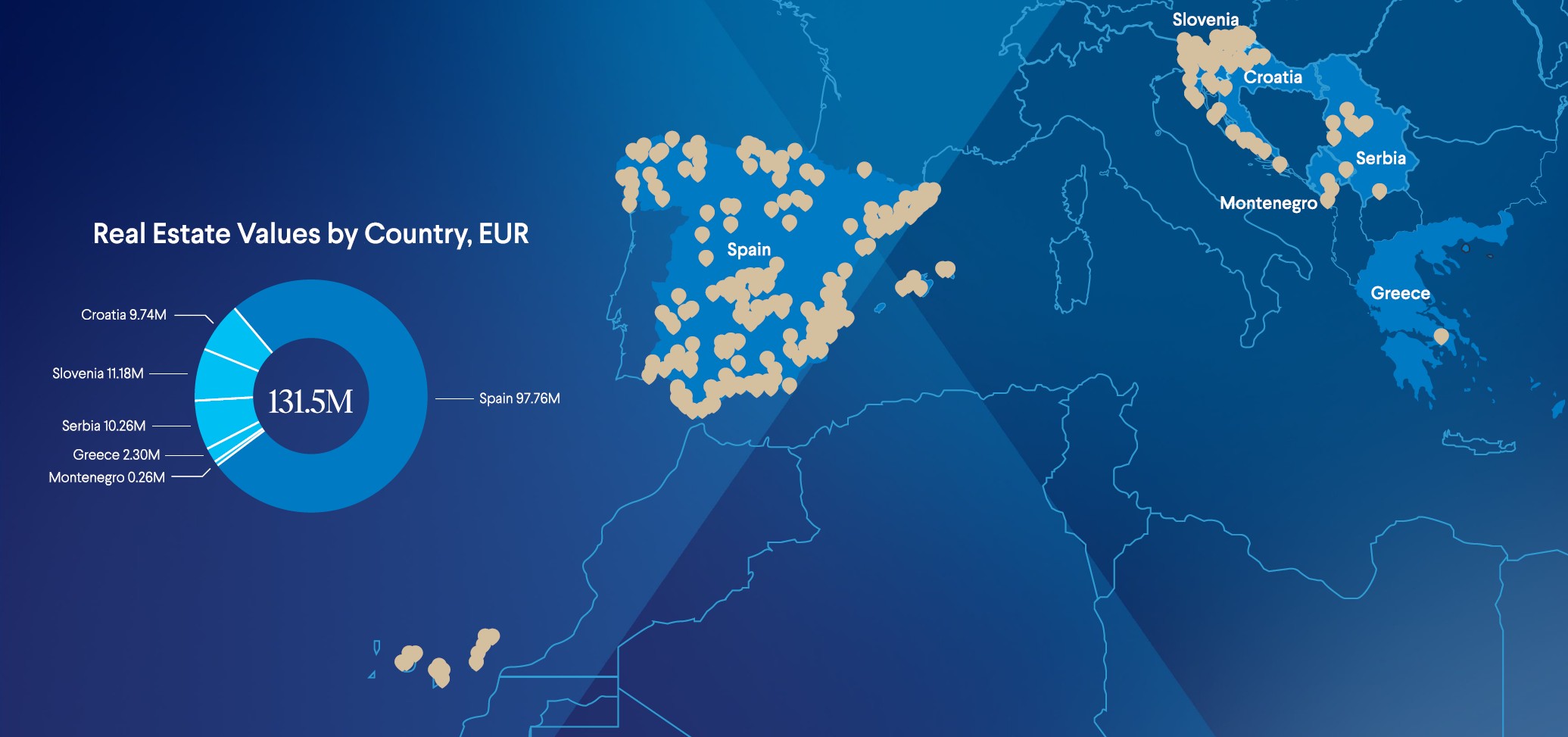

ASSET GEO LOCATION

COMPANY OVERVIEW

LynxCap Investments AG is a Swiss investment firm specializing in distressed assets, headquartered in Zug, Switzerland. It operates through two Luxembourg-based subsidiaries, LCL Securities SCS and LCL Opportunities SCS, which are integral to its funding and asset acquisition activities. The company has structured its operations and financing to align with a focused investment strategy and tax efficiency.

LynxCap’s core focus is on acquiring and managing distressed and non-performing loan (NPL) portfolios, with a primary emphasis on the Spanish market.

As part of its strategic role, LynxCap operates as a Swiss entity that functions as a cost center, overseeing the group’s investment vehicles. It ensures operational efficiency while reinvesting profits into its investment strategy, further strengthening its portfolio and long-term growth objectives.

FINANCIAL PERFORMANCE AND FUNDING

LynxCap Investments AG (2023):

• Primarily financed through shareholder subordinated notes, amounting to approximately EUR 14 million. These notes provide a stable financing base while reflecting shareholder commitment.

• Reported a profit of CHF 1,072,411 in 2023, reversing prior year losses.

• Managed total assets of CHF 19.7 million, with significant holdings in financial assets and loans to related parties, reinforcing its role as a management hub.

• Shareholders’ equity remained negative at CHF ‑557,680, driven by historical losses, though mitigated by subordinated loans and reinvestment of profits.

LCL Opportunities SCS (2023):

• Total assets increased to EUR 41.6 million from EUR 32.7 million in 2022, driven by investments in NPL portfolios.

• Realized a consolidated net profit of EUR 1.85 million, primarily attributable to interest income from financial assets.

• Issued non-convertible debenture loans totalling EUR 30.87 million, primarily used for asset acquisitions.

LCL Securities SCS (2023):

• Reported equity of EUR 4.26 million and net profit of EUR 567,271.

• Generated EUR 1.5 million in interest income from subordinated notes issued by affiliated entities, reflecting its role in the group’s funding structure.

MANAGEMENT TEAM

Managing Director, Portfolio Management

Managing Director, Portfolio Management

LynxCap Investments AG

Starting in 2009 Alexander Zwinger led the Analysis department (and since 2012 the Operations department) of DDM Group AG. He was responsible for establishing and continuously developing portfolio valuation and pricing models, portfolio management, and reporting processes. Mr. Zwinger spearheaded the efforts to prepare DDM for an IPO on the Nasdaq First North. Prior to DDM, Mr. Zwinger worked at Aktiv Kapital. Alexander holds a Master’s degree in Economics from University of Bielefeld, Germany with a background in Economics, Statistics and Empirical Analysis.

Managing Director, Transactions

Managing Director, Transactions

LynxCap Investments AG

Prior to joining LynxCap Group, Peter Kadish was responsible for NPL portfolio acquisitions at DDM Group AG, managing key transactions in the CEE region, with a specific focus on the Slovenian, Croatian, and Serbian markets. Mr. Kadish has a background in private equity and investment banking. He served as an Investment Director at a EUR 5 billion private equity and credit fund and was also Head of Syndicate at an investment bank, where he was responsible for major oil and gas Eurobond placements. Peter holds a BA in Economics from the University of Latvia and was an Erasmus student at Ghent University in Belgium. He also holds a Master’s degree in Banking and Finance from the University of Sheffield, UK, and completed an Executive MBA from London Business School. Peter is a CFA charterholder.

Managing Director, Transactions

Managing Director, Transactions

LynxCap Investments AG

Konstantin Kraiss was responsible for all aspects of NPL portfolio acquisitions for DDM Group AG in the CSEE region, with a special focus on the Romanian, Hungarian, and Greek markets. Prior to DDM Group, Mr. Kraiss was employed by Deloitte, Ernst & Young, and leading regional private equity funds, focusing on mergers and acquisitions as well as financial and strategic advice to industry-leading companies and financial institutions in Central and Eastern Europe. Mr. Kraiss has 15 years of experience in corporate finance and a proven track record of successful cross-border transactions with a total investment value exceeding EUR 1 billion. He holds a BSc in Business and Economics with a specialization in Finance from the Stockholm School of Economics in Riga, Latvia.

Vice Chairman

Vice Chairman

LynxCap Investments AG

Dr. Manuel Vogel is an international VAT and tax specialist and serves as the Chairman of Kreston VAT SIG at Kreston International. He was one of the two founding partners of DDM Holding and a Board Member of DDM Holding AG and its subsidiaries. Prior to his role at DDM, Dr. Vogel was responsible for tax and accounting for the Pan-European Purchased Debt Operation at Intrum Justitia from 2004 to 2008. He has also served as a Board Member for several Swiss companies.

CEO

CEO

LynxCap Investments Asia

Alexander has been a corporate transactional and commercial lawyer in Greater China for over two decades. He previously served as the data privacy practice leader (Corporate) at Hill Dickinson in Hong Kong. Throughout his career, Alexander has handled numerous mergers and acquisitions, private venture investments, and cross-border transactions across Asia in a wide range of industries. He holds a bachelor’s degree in political science, specializing in Chinese foreign policy, from the University of Arizona, and a doctorate degree in law from St. John’s University. Additionally, he has obtained both CIPM and CIPP/E certifications from the IAPP. Alexander is multilingual and speaks English, French, Mandarin, and Spanish.

Head of IT

Head of IT

LynxCap Investments AG

Paul has over 15 years of experience in the IT industry. Primarily focused on the finance sector, Paul has held a wide variety of roles in several multi-national corporations as well as holding consultancy roles at the likes of Credit Suisse, Nordea Bank and Novartis. An advocate for the Agile methodology, Paul has successful managed the implementation of numerous business-critical application and processes throughout his career. Paul is a British citizen and studied engineering in Manchester, UK. However, further developing his career and relocating to Switzerland in 2006 where he now heads global IT operations.

Portfolio Manager

Portfolio Manager

LynxCap Investments AG

Prior to joining LynxCap Investments, Katerina managed large retail and corporate NPL portfolios at DDM Group AG, covering the large territory of the CEE region, including Russia, Poland, Slovenia, Croatia, Slovakia, and the Czech Republic. Katerina holds bachelor’s and master’s degrees in Finance and Banking from the Warsaw School of Economics. She speaks English, Russian, Polish, and Italian.

Director, Legal

Director, Legal

LynxCap Investments Luxembourg

Dora Vrkic Oriskovic is an internal legal advisor responsible for transactions. Prior to joining LynxCap, she was part of the Group Transaction Team at B2Holding Group, where she was responsible for large transactions and co-investments within the Group in addition to supervising and supporting local acquisition and deal teams. Earlier in her tenure at B2, Ms. Oriskovic was part of the Acquisition department at B2 Kapital d.o.o., a Croatian subsidiary of B2Holding Group, where she was in charge of NPL portfolio acquisitions, due diligence and transactional support across the CEE and SEE regions, with focus on CE markets. Ms. Oriskovic holds a Master’s in Law from the University of Zagreb.

Director, Valuations & Transactions

Director, Valuations & Transactions

LynxCap Investments Luxembourg

Tea Puh is a seasoned investment manager in charge of the LynxCap Luxembourg office. Prior to joining LynxCap, she was the Group Head of Portfolio Management with B2Holding Group, a listed pan-European NPL purchaser and servicer with a presence in over 20 European countries. At B2Holding, Ms. Puh was responsible for the execution of B2’s investment strategy, maximising portfolio performance, managing the new acquisition approval process and existing portfolio reforecasting. Ms. Puh has a background in the acquisition and management of NPL portfolios in the majority of the European NPL markets with a particular focus on the CE markets. Ms. Puh holds a Masters in Finance from the University of Zagreb.

Head of Analytics

Head of Analytics

LynxCap Investments AG

Prior Experience: Starting in 2013, Felipe joined the DDM Group AG’s Analysis Department. He was part of a team of analysts focused on creating tailor-made pricing models for a variety of debt portfolios across the CSEE region, as well as maintaining and enhancing existing valuation routines in order to support a strong pipeline of ca. 150 prospective investments per year. In 2018, he became the head of the department and in 2019 he joined LynxCap Investments.

Education: BSc+MSc in Economics, MSc in Banking and Quantitative Finance, Universidad de Valencia, Spain.

Director, Head of Legal Affairs

Director, Head of Legal Affairs

LynxCap Investments Slovenia

Prior to joining LynxCap Group, Mina was part of the Transactions and Acquisitions Team at DDM Group, where she was involved in all major NPL portfolio acquisitions and due diligence processes in the CEE region, specifically focused on the Slovenian and Croatian markets. Due to her background in legal practice, she was also involved in day-to-day business with the Operations Team and in Corporate Governance matters. Mina holds a Master’s in Law from the University of Ljubljana and an E.MA focused on Corporate Social Responsibility in cooperation with Maastricht University. She passed the Slovenian Bar Exam in 2017.

Director, Investor Relations

Director, Investor Relations

LynxCap Investments AG

Prior to joining the LynxCap team, Sameer had 15 years of experience in the real estate sector. As a former Senior VP in Sales at Sotheby’s International Realty Canada, he played a strategic role in the acquisition, disposition and management of real estate portfolios on behalf of a local and global network of clientele. Sameer holds an international executive MBA (IEMBA) from the University of St. Gallen in Switzerland and has a proven track record in engaging with investors and driving strategic growth.

Sales and Marketing Manager

Sales and Marketing Manager

LynxCap Investments Asia

Jason Kim has over 25 years of experience in business development and sales specializing in fixed income and structured financial products. Jason was the Managing Partner at Olympus Partners Asia Limited, responsible for origination and capital raising for private market transactions, as well as its Responsible Officer holding Type 1, 4, and 9 SFC licenses. Previously, Jason was Head of Fixed Income Sales at Mizuho Securities in Hong Kong; Director of Fixed Income and Derivative Sales at Credit Suisse Hong Kong; Head of Sales at Credit Suisse Asset Management Korea; and Head of Derivatives Sales at Goldman Sachs Korea. Jason has a bachelor’s degree in business from Yonsei University of Korea and is bilingual in English and Korean.

Financial Controller

Financial Controller

LynxCap Investments AG

Cheshta brings over a decade of experience across financial analysis, portfolio valuation, and budgeting across Europe and Asia.

Prior to joining LynxCap, Cheshta was a Portfolio Analyst at B2Holding Group, a publicly listed pan-European NPL purchaser and servicer. Based in Luxembourg, she was responsible for the independent valuation and performance management of unsecured debt portfolios in Nordics. Previously, she worked as a Budget Controller at Samsung Electronics in France, where she implemented financial planning processes and budget guardrails for key French retail clients. She began her career at S&P Global Market Intelligence in India, holding multiple roles over six years focused on capital markets data, analytics, and process optimization.

Cheshta holds a master’s degree in mathematics and finance (MMEF) from Pantheon-Sorbonne University, Paris, and a Bachelor’s degree in Business Studies (Finance) from the University of Delhi.

LCLOpportLux 9.8% 15/05/2028

Issue Amount

EUR 3,000,000

For Professional Investors from

![]() Europe

Europe

| Issuer | LCL Opportunities 3 S.a.r.l. |

|---|---|

| Jurisdiction | Luxembourg |

| Name | LCLOpportLux 9.8% 15/05/2028 |

| ISIN | XS3076283921 |

| Industry | Real Estate |

| Rank | Sr. Secured |

| Instrument Type | Bearer Bond |

| Issue Amount | €3,000,000 |

| Min. Investment Amount | €100,000 |

| Coupon | 9.8% p.a. |

| Coupon Payment | fixed-quarterly |

| Issue Date | 23 May 2025 |

| Maturity | 15 May 2028 |

| Accepted Currencies | EUR, USD, USDC, EURC |

| Eurorating Bond Rating | BBB- |

| Price (Ask) | 100% |

| Yield to Maturity | 10.2% |

| Start of Offering | TBA |

| End of Offering | TBA |

| Secondary Trading | No |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

The Issuer is solely responsible for all contents and information provided regarding the offering. BMCP GmbH acts as a pure intermediary and assumes no liability for the accuracy of the provided content.

For its distribution services BMCP receives a transaction fee of 2.5% — 4.25% on capital raised. The fees paid are used exclusively to cover our company’s operating costs, in particular personnel costs and employee training, technology and infrastructure, regulatory and legal costs, and business operations. This aims to increase the quality of BMCPs distribution services for clients.

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE BONDS BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.