fija ETH GMX Strategy

Gaining access to high yields on your Ethereum through fija’s fully automated strategies, packaged as a regulated security

This strategy generates dynamic returns by providing ETH liquidity, earning from trading and borrowing fees, while smartly hedging to maintain full Ethereum exposure. Seize this opportunity to reap high returns DeFi has to offer in a fully compliant and very simple way — through fija.

With robust risk management triggers and automatic rebalancing mechanisms, your investment stays protected and optimized for maximum efficiency.

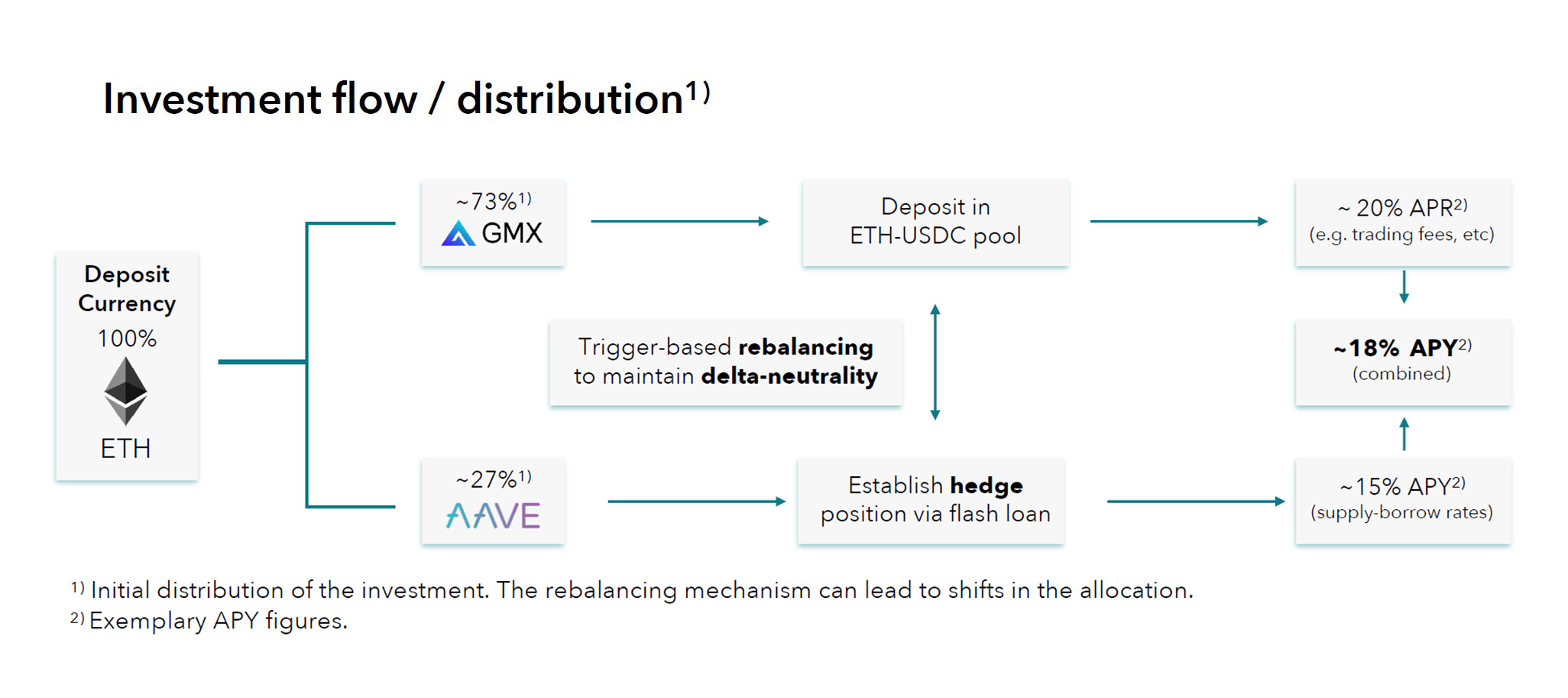

The strategy operates on GMX, a leading DeFi platform, by providing liquidity in form of ETH to the ETH-USDC pool. Returns are generated through trading and borrowing activities of traders in the pool. To maintain the full exposure to ETH price movements, the strategy builds a hedge on Aave.

Invest in the fija ETH GMX Strategy and leverage the power of top DeFi protocols at the click of a button — fully regulated.

HIGHLIGHTS

FIJA STRATEGY OVERVIEW

High yields on Ethereum by providing liquidity to GMX liquidity pools and hedging volatility and open interest risks on Aave for a fully Ethereum delta-neutral strategy.

fija ETH GMX Strategy

The fija ETH GMX Strategy is based on the decentralized perpetual exchange GMX that operates on the Arbitrum and Avalanche networks. The platform has undergone an update to V2 in 2023 (read more about V2 here) and since then has been one of the most used platforms for traders and liquidity providers in the DeFi space.

Key Facts:

• Blockchain: Arbitrum One

• Deposit Currency: ETH

• Tokens used: USDC, ETH

• Protocols used: GMX, AAVE

DETAILED STRATEGY DESCRIPTION

Liquidity providing on GMX

To generate a return, the strategy provides liquidity in the deposit currency ETH to the GMX liquidity pool ETH-USDC which facilitates various activities for traders including long/short positions and swap trades. Providing liquidity generates returns from several streams such as trading & swap fees, trader liquidations and borrowing fees that traders pay for using the provided liquidity. The annual return generated by the pool is dynamic and dependent on the trading activity within the GMX ecosystem. The more trading volume generated by traders, the higher the return of the strategy.

Hedging on Aave

By providing liquidity to the ETH-USDC pool on GMX, part of the deposit currency ETH gets automatically swapped to USDC as the pool is composed of both assets. As the strategy is delta- neutral with regards to ETH, it’s imperative to keep the full exposure to the price behavior of Ethereum. The strategy achieves this through a hedging mechanism utilizing the decentralized lending platform Aave, where USDC is borrowed and used to buy ETH which is also provided as collateral, effectively creating a long position for ETH.

While this procedure is a capital-efficient way to eliminate the USDC price exposure of the strategy, there is one more aspect that needs to be considered to achieve full ETH delta-neutrality. The liquidity pools serve as counterparty for users on GMX trading the respective market pairs (in this case ETH-USDC). This means that liquidity providers stand to gain when traders incur losses and vice versa. As the positions of traders and hence their wins and losses continuously change, the strategy constantly monitors the open interest of the trading pair which is a clear sign if traders are currently long or short on the trading pair. The net effect of the open interest on the liquidity pool is included in the hedging mechanism, effectively reducing or increasing it depending on the net positions of traders.

Risk Management & Optimization

To ensure the delta-neutrality of the strategy and the effectiveness of the hedge mechanism, the strategy has two distinct rebalancing mechanics and triggers. The strategy constantly monitors the effective exposure to the Ethereum price (which is intended to be 100%). Should that ETH exposure become <98% of the total strategy value, the rebalancing mechanism is triggered, the hedge adjusted, and the ETH exposure re-gained.

The second rebalancing mechanic concerns the hedge mechanism itself. The efficiency of the hedge position on Aave can be tracked using their so-called Health Factor. The Health Factor measures the relation between provided collateral and loans that are borrowed against that collateral. The Health Factor has a lower limit where positions with a Health Factor <1 are subject to liquidation. The strategy has a defined target Health Factor of 1.5. The rebalancing of the strategy will trigger should the Health Factor fall below the value of 1.2 to avoid liquidation. On the upper side, the strategy will also rebalance should the Health Factor rise above 1.7 to ensure maximum capital efficiency.

COMPANY OVERVIEW

fija builds the infrastructure for investors to earn high yields in Decentralized Finance (DeFi) in a compliant and straightforward manner without the complexities of blockchain technology. Investors can easily earn interest from DeFi lending and liquidity protocols by purchasing fija’s regulated security token. As a bridge between Traditional Finance (TradiFi) and DeFi, fija enables everyone to earn high yields in DeFi without engaging in the intricacies of decentralized finance.

• Founded in 2022

• Munich based

• Seasoned founder team

For detailed information about the emissions and the products offered by fija Capital please visit the website https://fija.finance/ or https://fijacapital.com/

MANAGEMENT TEAM

Christoph Scholze, Lieven Hauspie and Tim Federspiel (from left to right)

Co-Founder & CEO

• Oversees Sales, Business Development & Product

• Build previous companies in fintech and regulated industries

• 15 years of experience as Director of Business Development and Head of Product for leading cooperations such as Bertelsmann and CHECK24

Co-Founder & CTO

• Oversees the fija technology infrastructure and leads the fija tech team.

• Brings 20 years of experience in building and scaling software development teams across various industries.

• Former VP of Technology at Finoa and VP of Engineering at Honeywell/Elster.

• Proven track record of building and scaling tech teams from the ground up to over 100 members.

Co-Founder & COO

• Oversees the operational tasks within fija and is responsible for the DeFi strategies

• 7 years experience in the crypto and DeFi space with focus on yield strategies

• 4 years experience in Strategy Consulting at a Big4 company

• Active early investor in a range of crypto & web3 projects

TOKEN CLASSIFICATION

The bonds are securities without a fixed term, without current interest and without fixed repayment. The bonds to be issued are each no-par value, uncertificated, subordinated, token-based bonds that are subject to a pre-insolvency enforcement block. For each bond to be issued, an issue-related fija Token with an issue-specific denomination (the “fija Token”) will be issued by the Issuer to the investors (the “Investors” or “Investor”) representing the rights under the bond.

To generate the fija Tokens, the Issuer has had a smart contract created that links the fija Tokens to the bonds. This smart contract is called the “Vault Smart Contract” by the Issuer. A register is stored in the Vault Smart Contract. Investors are not entered in the register by name, but with their blockchain address.

The bonds do not have a fixed maturity date. Maturity of the bonds is subject to termination by the investors or the issuer. Investors have the right to terminate the bonds in whole or in part at any time without observing a notice period. The bonds do not bear interest on an ongoing basis. In the event of termination of the bonds, the investor is entitled to the delivery of crypto assets in accordance with the formula set out in the Token Terms and Conditions. The bonds will not be redeemed in fiat currency. After termination of the bonds, the investor receives the crypto assets identical in type and class to those which they sent to the issuer when subscribing to the bonds.

For further information please review the document „Allgemeine Beschreibung des Angebotsprogramms“ (in German)

Step 1: Registration and qualification as a registered investor

Investors who wish to invest in fija ETH GMXv2 BM Token must register below. After successful registration, please check the inbox of the email address provided.

Step 2.1: Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

All prospective investors must provide BMCP GmbH & fija Capital UG with KYC information in order for the issuer to perform the required KYC and AML analyses and to otherwise confirm that the investor meets other suitability requirements that the issuer may require from time to time. fija Capital UG and BMCP GmbH reserves the right to reject any investment at its sole discretion.

Step 2.2: IMPORTANT — Provide your EVM Wallet address during the KYC process

While completing step 2.1 and providing your KYC information, you will also be asked to provide your EVM wallet address to be whitelisted for the fija Capital UG platform.

Step 3: Subscription process

After completing step 2.1 and 2.2, you will be notified as soon as your wallet address is on the whitelist and you will get access to the fija Capital Investment Platform. You can then connect f.e. via WalletConnect, and select and confirm the investment amount on the fija Capital Investment Platform.

fija ETH GMXv2 BM Token

Target Fund Raise

EUR 8,000,000

For Retail Investors from

![]() Germany

Germany

For Professional Investors from

![]() Europe

Europe

| Issuer | fija Capital UG |

|---|---|

| Jurisdiction | Germany |

| Instrument Type | Bearer Bond |

| Blockchain | Arbitrum |

| Tokens used | USDC, ETH |

| Protocols used | GMX, AAVE |

| Total Investment Volume | €8,000,000 |

| Min. Investment Amount | N/A |

| Max. Investment Amount | N/A |

| Targeted Yield | 13–18% p.a. |

| 90-day Average Yield | 17.8% p.a. |

| Estimated Lifetime Yield | 16.2% p.a. |

| Start of Offering | 15 July 2024 |

| End of Offering | N/A |

| Term | anytime-cancelable |

| Accepted Currencies | ETH |

| Secondary Trading | No |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration. We are available for questions at any time – contact@blackmanta.capital

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

The Issuer is solely responsible for all contents and information provided regarding the offering. BMCP GmbH acts as a pure intermediary and assumes no liability for the accuracy of the provided content.

For its distribution services BMCP receives ongoing fees for investors AUM coming through BMCP of 12,5% of the revenue on deposits. The fees paid are used to cover our company’s operating costs, in particular personnel costs and employee training, technology and infrastructure, regulatory and legal costs, and business operations. This aims to increase the quality of BMCPs distribution services for clients.

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE BONDS BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.