Investment in UK RE — Focus geared towards UKCH investment

The case for UK Real Estate Investment in 2023:

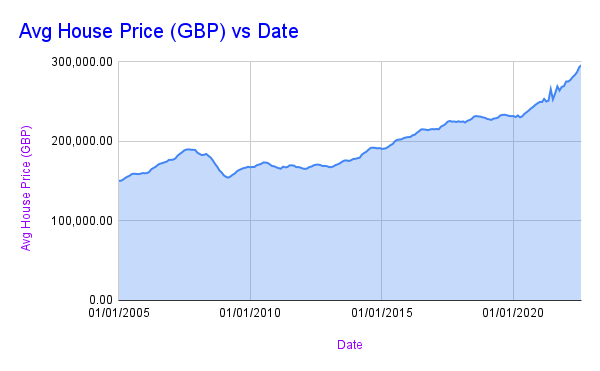

The proven track record and consistent growth of UK property values, which are forecasted to continue long-term, makes investment in UK property one of the best ways to provide long-term financial security as well as diversification to your investment portfolio, or even as a stand-alone investment itself.

The North East of England continues to have the lowest average house price (£164,395), while Yorkshire and East/West Midlands are also on the lower ends (£212,313, £255,144, and £255,202 respectively). UKCH is an excellent investment project to enter into this high growth potential region, a project with a strong ethical focus and equally strong investment returns. The benefits of UK real estate investment include:

✓ Great Britain is in the top five investment destinations in the world. Property investment in the UK serves as a hedge against inflation and also appreciates in value.

✓ Regular and increasing cash flow from rental income

✓ Long-term capital appreciation and growth

✓ Tax benefits

✓ Diversification of investment portfolio

✓ Increasingly thriving rental market

✓ Can be a hands-off, passive investment strategy

✓ Right in the future to apply for permanent residence and eventually British citizenship.

The GBP being weaker in recent months has made UK property investment more affordable and attractive to foreign investors. This in addition to the fact that the pound has been and is expected to continue to recover makes now a prime time to invest in the UK housing market.

Rental Properties:

House price growth is outpacing earnings by a wide margin, which is pushing up mortgage repayments relative to incomes. Therefore, the more European style of ‘lifetime renting’, where in Germany for example 43% of people own their home, is becoming increasingly pervasive now in the UK. Research estimates that UK renters will outnumber homeowners by 2039. With the worsening cost of living crisis and consequential delayed and increased challenge posed to people today in the UK to get on the first rung of the property ladder, rent prices have continued to increase as it increasingly becomes a landlords market. The lack of properties available in addition to rental properties being taken up quicker and quicker, means landlords are able to perpetually increase rental prices, in many cases rent payments are more expensive than mortgages.This untenable reality makes investments such as UKCH all the more appealing as an investment.

Rental properties are largely recession proof also, being a basic need to have a roof over one’s head, means demand always remains high. The high rental demand and thus high rental returns forecasted long-term is appealing to investors that want to build a long-term portfolio and invest in the UK.

Economics 101: Supply & Demand…

Given the chronic shortage of housing supply in the UK, and the fact that the population is still increasing, the price of housing is forecasted to continue increasing for the foreseeable future. The UK’s population is expected to reach 74 million in the next 20 years and demand is growing in the UK property market. Recent government statistics reveal that the UK population grew by an average of 4 million between 2018 and 2021. Because of the fact that demand for housing in Britain is not being met with supply, there is rampant house price inflation, with the average listing price being 308,698 GBP in 2022.

Many regional areas in the UK – especially those forecasting above-average price growth (such as the aforementioned midlands and northern England, see UKCH) remain affordable in the current market and are experiencing high demand as a result of low supply.

If you are interested in this unique investment opportunity, please visit https://blackmanta.capital/ukch/ for more information on how to participate in the rising UK Housing Market.