USD Yield Farming Index — USD3

Gain access to a leading USD denominated yield-bearing stablecoin, fully collateralized by DeFi yield

Unlock USD-denominated DeFi yields with Reserve Protocol’s USD3 Decentralized Token Folio, structured as investment-grade, performance-linked notes. Tap into innovative crypto-native returns within a regulated framework tailored for institutional compliance and traditional investment processes.

Created by Reserve Protocol, USD3 is a USD denominated yield-bearing stablecoin. USD3 provides exposure to a basket of various leading DeFi protocols, such as Aave, MakerDAO, Compound & more.

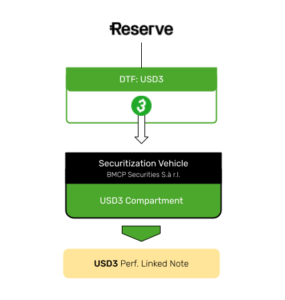

Traditional investors can now gain institutional-grade access to USD3 by Reserve. The product is securitized via BMCP Securities S.à r.l., and its underlying USD3 is securely custodied by Fortuna Custody Solutions.

HIGHLIGHTS

PROJECT OVERVIEW

USD3 by Reserve Protocol is introduced as a regulated financial instrument, brought to market through a collaboration between Black Manta Capital Partners, Sors Digital Assets, and Fortuna Custody Solutions. This offering is designed to provide traditional investors with a compliant and accessible way to tap into USD-denominated DeFi yields.

Issued via BMCP Securities S.à r.l., the USD Yield Farming Index — USD3 product is uniquely structured within its own dedicated compartment in our Luxembourgish securitization vehicle bearing an unique ISIN. This setup features institutional-grade wallet infrastructure, including secure fiat and crypto on/off-ramps and robust custody of the underlying USD3 assets, provided by Fortuna Custody Solutions.

Issued via BMCP Securities S.à r.l., the USD Yield Farming Index — USD3 product is uniquely structured within its own dedicated compartment in our Luxembourgish securitization vehicle bearing an unique ISIN. This setup features institutional-grade wallet infrastructure, including secure fiat and crypto on/off-ramps and robust custody of the underlying USD3 assets, provided by Fortuna Custody Solutions.

Structured as a Performance Linked Note (PLN), the product aims to closely mirror the returns generated by the underlying USD3 token. This design grants investors access to novel yield opportunities within the crypto space, all delivered within a regulated wrapper. Consequently, investors benefit from exposure through a familiar security format while preserving the essential characteristics and performance of the native crypto asset.

UNDERLYING: USD3 BY RESERVE PROTOCOL

Founded in 2022, Reserve Protocol is a multi-chain platform on Base, Ethereum, and soon Solana, enabling the creation, trading, and redemption of crypto index products called DTFs (Decentralized Token Folios). These on-chain assets, like USD3, bundle entire investment narratives or strategies into a single token, allowing users to gain diversified exposure through one seamless trade — much like a crypto-native index fund.

About USD3

USD3 is a yield-bearing stablecoin DTF developed by Reserve Protocol, designed to provide investors with seamless access to USD-denominated DeFi yields without the complexities of managing individual lending and borrowing positions. By integrating with blue-chip DeFi protocols such as MakerDAO, Aave, Compound, and Morpho, USD3 offers exposure to stable, overcollateralized yields within a robust and transparent framework.

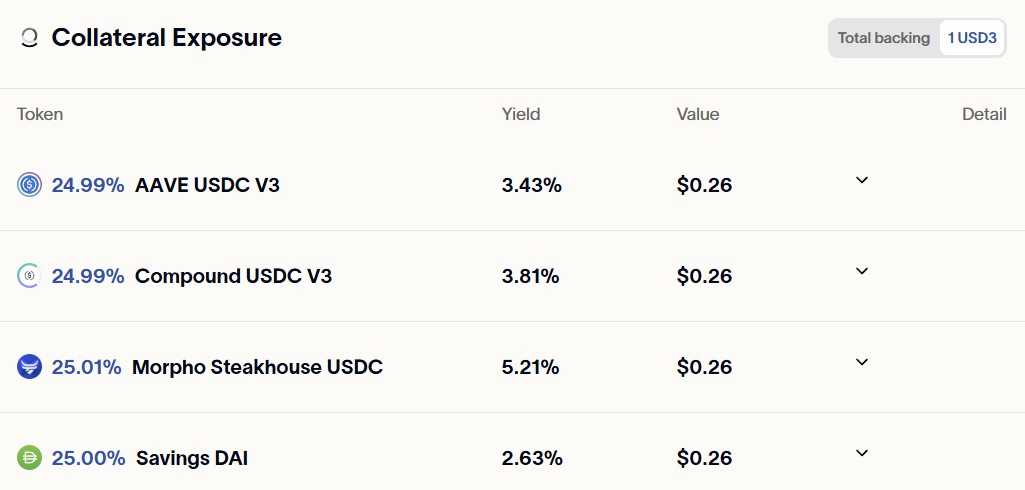

The token is fully backed by a diversified basket of yield-generating stablecoins, including assets like Compound USDC V3, Morpho Steakhouse USDC, and Savings DAI. This structure ensures that USD3 maintains a 1:1 peg to the US dollar while delivering competitive returns, with yields influenced by the utilization rates and dynamics of the underlying DeFi platforms.

ABOUT DEFI YIELD

DeFi yield refers to the interest or rewards earned by participating in decentralized finance protocols, primarily through lending assets or providing liquidity. Platforms like Aave, MakerDAO, Compound, and Morpho enable users to supply assets such as stablecoins to lending markets, where they are borrowed by others, generating interest for the suppliers. These protocols operate on smart contracts, ensuring transparency and automation in the lending process.

Yields in DeFi are typically dynamic, adjusting based on real-time supply and demand, protocol-specific incentives, and governance decisions. For instance, higher borrowing demand for a particular asset can lead to increased interest rates for lenders.

ABOUT THE ISSUER

Our Luxembourg-based securitization vehicle — BMCP Securities S.à r.l. — offers a compartment structure, which segregates assets and liabilities for each distinct issuance, protecting each compartment from the risks associated with other compartments and assets. The vehicle operates under Luxembourg’s robust legal framework and is designed to accommodate diverse financial instruments and market access.

Read more here: https://blackmanta.capital/securitization/

About Black Manta Capital Partners

Black Manta Capital Partners is a next generation investment bank focused on digital and tokenized assets, operating a fully regulated investment platform for issuances in the European capital market, as well as a Securitization Vehicle out of Luxembourg. With offices in Europe, Asia and Americas, Black Manta Capital offers full-service support for all technical, financial, and legal aspects of asset and security tokenization on a global scale.

ABOUT FORTUNA CUSTODY SOLUTIONS

Founded in 2021, Fortuna Custody Solutions is a licensed VASP (Virtual Asset Service Provider) registered with the Central Bank of Ireland (CBI) providing institutional-grade custody solutions. Fortuna is now enduring a MiCa regulation process in Ireland with the Central Bank of Ireland (CBI).

Operating as Custodian.

ABOUT SORS DIGITAL ASSETS

Founded in 2018, Sors Digital Assets is a licensed VASP (Virtual Asset Service Provider) registered with the Central Bank of Ireland (CBI), providing Portfolio Management, On/Off Ramp, OTC, Market Making, Launch & Advisory Services.

Operating as Compartment Manager and On/Off-ramp Provider.

USD Yield Farming Index — USD3

Volume

EUR 50,000,000

For Professional Investors from

![]() Europe

Europe

| Issuer | BMCP Securities S.à r.l. |

|---|---|

| Jurisdiction | Luxembourg |

| Instrument Type | Performance Linked Note (PLN) |

| ISIN | LU3087210947 |

| DeFi Yield | up to 10% APY (in USDC) |

| Redemption | Anytime-Redeemable |

| Maturity Date | 31 December 2045 |

| Min. Investment Amount | €10,000 |

| Max. Investment Amount | N/A |

| Accepted Currencies | EUR, USDC |

Underlying USD3 Details

Conditions

| Fees | See investor documentation |

|---|

Service Providers

| Issuer | BMCP Securities S.à r.l. |

|---|---|

| Compartment Manager | Sors Digital Assets |

| Custodian | Fortuna Custody Solutions |

| On/Off-ramp Provider | Sors Digital Assets |

Investor Documentation

More information about the issuer, as well as the legal documentation you will receive after registration and during the subscription process. We are available for questions at any time – contact@blackmanta.capital

Interested investors must register and qualify as professional client according to Annex II of DIRECTIVE 2014/65/EU. A professional client is a client who possesses the experience, knowledge and expertise to make its own investment decisions and properly assess the risks that it incurs.

Potential investors must successfully complete an investor identification process in accordance with anti-money laundering rules in order to invest. Only identified and verified investors can participate in the offering and purchase tokens. There is no preferential subscription right for investors. There is no entitlement to allocation of the tokens. Acquired tokens will be credited to the investors’ personal wallet and simultaneously recorded in the issuer’s register.

Legal Information

The information in this Offering is intended solely for investors who are not located or resident in certain other restricted jurisdictions and who are not otherwise permitted to receive such information.

The information in this Offering does not constitute an offer or solicitation to purchase any securities in the United States, Australia, Canada, Japan, South Africa, the Republic of China or in any other jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation.

Users of this information are requested to inform themselves about and to observe any such restrictions. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the United States Securities Act of 1933, as amended.

An investment involves considerable risks and can lead to the complete loss of the assets invested. In the interests of risk diversification, only those amounts of money should be invested that are not required or expected to be returned in the near future. However, the risk is limited to the investment sum made and there is therefore no obligation to make additional contributions.

DISCLAIMER

MARKETING NOTICE PURSUANT TO § BT 3.1.1 MACOMP

THE FOLLOWING IS A MARKETING COMMUNICATION AND NOT AN INVESTMENT RECOMMENDATION. THIS ADVERTISING COMMUNICATION IS THEREFORE NOT A SUBSTITUTE FOR INVESTMENT ADVICE AND DOES NOT TAKE INTO ACCOUNT THE LEGAL PROVISIONS PROMOTING THE INDEPENDENCE OF FINANCIAL ANALYSES, NOR IS IT SUBJECT TO THE PROHIBITION ON TRADING FOLLOWING THE DISSEMINATION OF FINANCIAL ANALYSES.

THIS SITE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES TO ANY PERSON IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL. THE DISTRIBUTION OF THIS OFFER MAY BE RESTRICTED BY LAW IN CERTAIN JURISDICTIONS. FAILURE TO COMPLY WITH SUCH RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE SECURITIES LAWS OF SUCH JURISDICTION.

THE OFFER IS ONLY AVAILABLE TO INVESTORS FROM EUROPE WHO HAVE EXPRESSED AN INTEREST IN INVESTING IN THE OFFERING.

THE INVESTMENT INTO THE PROJECT BEARS A RISK OF TOTAL LOSS OF THE INVESTED CAPITAL. IN SUCH A CASE THE INVESTOR WILL NOT RECEIVE HIS INVESTED CAPITAL BACK; INTEREST; OR ANY OTHER REMEDIES.